Credit Default Swaps Now Total $283 Trillion

"Large amounts of risk, particularly credit risk, have become concentrated in the hands of relatively few derivatives dealers, who in addition trade extensively with one another." - Warren Buffet

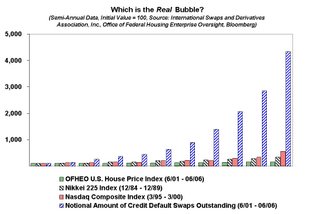

Mike Panzner has an eye-popping chart comparing the notional value of Credit Default Swaps outstanding to various other recent bubbles.

Conveniently enough, the online Journal's MORNING BRIEF provides a primer on the subject. I've included the passage in full.

Mike Panzner has an eye-popping chart comparing the notional value of Credit Default Swaps outstanding to various other recent bubbles.

Conveniently enough, the online Journal's MORNING BRIEF provides a primer on the subject. I've included the passage in full.

Treating Derivatives As a Transnational Risk

By JOSEPH SCHUMAN

THE WALL STREET JOURNAL ONLINE

Senior officials at the Federal Reserve, the Securities and Exchange Commission and its British counterpart today issued an unusual joint warning that the financial risks of an increasingly global and mushrooming derivatives market are too big for any one country to oversee.

But first, a look at just how big that market is getting: Last week the International Swaps and Derivatives Association said that at the end of June, the outstanding nominal value of swaps and derivatives was $283.2 trillion. As the New York Times pointed out over the weekend, that's a lot of money, vastly superior to the combined gross domestic products of the U.S., European Union, Canada and China -- a paltry $34 trillion -- or the value of all U.S. homes, which is about the same amount. "To be sure, notional value is an exaggerated term as it greatly overstates the amount at risk in many contracts," the Times noted. "But the growth rate is real, and in the fastest-growing area of swaps -- credit default swaps -- notional value is closer to the amount at risk, because such swaps promise to make up the losses if a borrower defaults on the notional amount."

Today, New York Fed chief Timothy Geithner, SEC Commissioner Annette Nazareth and Sir Callum McCarthy, chairman of the U.K.'s Financial Services Authority, write in the Financial Times that the financial innovation fueling the creation of derivatives transactions often drives the market faster than the pace of improvement in market infrastructure. "In a more integrated global market, we will increasingly find ourselves compelled to pursue borderless solutions," they argue. "In the case of derivatives, a local or national solution would have been insufficient to protect domestic financial markets from the risks posed by market practices." Their comments follow a meeting hosted by the New York Fed yesterday where 16 leading global investment banks, institutional investors and international regulators discussed ways to upgrade back-office systems for derivatives trading. That meeting followed a similar gathering last year, where delays in the processing of derivatives were judged so serious they could create systemic problems if not addressed, the FT reports.

The participants in yesterday's meetings reported significant progress in cutting those backlogs -- something the regulatory trio calls "encouraging" -- but said the industry still has a serious problem with the backlogs in the equity-derivatives market. "Often it takes a crisis to generate the will and energy needed to solve a problem," the regulatory trio says, and "here, the industry deserves credit for acting in advance of a crisis." But more action seems to be needed by a financial industry that will closely watch their comments, as the FT reports. While U.S. and European regulators have cooperated extensively under the radar, until now national agencies have handled problems in their own markets. For example, the meltdown of Long Term Capital Management in 1998 was led by the New York Fed with the help of Wall Street. But with hedge funds among the biggest traders of derivatives, the potential cross-border vulnerability to market problems has increased. Earlier this month, the U.S. hedge fund Amaranth's big loss in the American gas markets set off a massive sale of its loans in London.

3 Comments:

Hey, good site, and I appreciate the plug. Just one thing, though: my last name is spelled "Panzner," not "Panzer."

Thanks, Mike. Corrected.

Hello, thank you for your site, I will visit it more often, as I study finance it is very useful for me. I will be looking for more news to come!

Post a Comment

<< Home