Dr Hussman Gets Technical

Dr. John Hussman's weekly market commentary is always time well spent. This week he points out some interesting divergences.

The NYSE registered 193 new highs on Friday. This was fewer daily new highs than we observed two weeks ago, and less than half the number registered in early May. Weekly new highs also fell far short of the April-May period. Despite the recent advance in the major indices, the Dow, S&P 500, Nasdaq and Russell 2000 all remain below their April-May highs. Since early April, when our measures of market action shifted from neutral to unfavorable, the S&P 500 has delivered a total return about equal to the return on risk-free Treasury bills (within a fraction of 1%). This simply is not a market that is “running away,” but rather one that is range-bound and now strenuously overbought.

Trading volume has also been dropping off substantially. While the link between trading volume and subsequent market action is not reliable as a single indicator, trading volume has a very useful role in either confirming or diverging from the indications given by prices, breadth, and other internals.

Even outside of our own measures of market action, the weakness in investor sponsorship here can be seen in generally followed indicators. Lowry's, for example, observes that trading volume has fallen off substantially as the recent rally has progressed, while the apparently strong breadth of the NYSE has been driven mostly by interest-sensitive stocks.

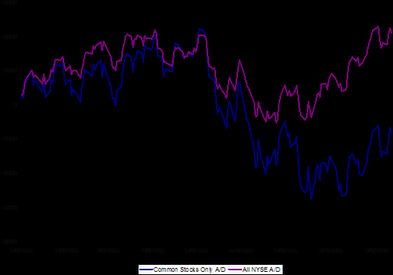

Dr. Hussman also points out the divergence in the quality of the market breadth.

The next chart depicts market breadth on two measures. The violet line shows the overall NYSE advance-decline line. The blue line is the NYSE advance-decline line restricted to common stocks (excluding preferred stocks, which behave essentially like bonds). Notice that in recent weeks, the recovery in common stocks has been very muted. This is also evident in the advance-decline profile of other exchanges.

0 Comments:

Post a Comment

<< Home