"...Black Gold, Texas Tea..."

RealMoney's Christopher Edmonds always has a well balanced view of the energy sector. In his latest review of oil and gas (available on TheStreet.com's free site) he says this recent selloff is more of a seasonal issue- not a sign of a serious change in trend. Thus a buying opportunity for the long term.

RealMoney's Christopher Edmonds always has a well balanced view of the energy sector. In his latest review of oil and gas (available on TheStreet.com's free site) he says this recent selloff is more of a seasonal issue- not a sign of a serious change in trend. Thus a buying opportunity for the long term.High prices in the oil patch may slump temporarily, but demand for crude oil and products remains robust.

In fact, demand continues to creep higher from a base of 84 million barrels per day.

Without additional supply in the coming years, this trend will push the current limits of global production, now in the range of 85 to 86 million barrels per day.

Some have argued that gasoline demand dropped as a result of high prices in recent months. In fact, the data indicate otherwise.

When gas prices rose from $2 to $3 a gallon in the U.S., consumer demand remained surprisingly strong. Recent declines in demand are the result of typical seasonal patterns, namely a slowdown in driving as the summer-vacation season winds to a close.

Demand for crude, both domestically and globally, remains firm and should stay brisk for the foreseeable future.

More importantly, he names names for those wanting to take a shot at what he thinks will be strong earnings (and presumably healthy guidance).

As an aside, the best argument I've seen from the Bulls for persistent strength in energy is actually the same one used by the energy/oil price bears: deepwater discoveries (that link leads to an article- with a Peak Oil bias- about the challenges of Chevron's newest development).

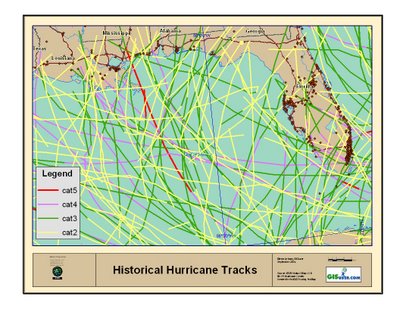

The bears say these new discoveries prove technology will solve our problems. I'm no energy/oil expert, but I look at reaching almost a mile and a half down to the floor of the Gulf of Mexico, then drilling another four or five miles, into a pile of rocks, right in the middle of hurricane alley, and says to myself, "Self, if the supply of oil isn't a problem then who in their right mind needs to go there":

We've come a long way from the day when a guy could find the sticky stuff while out shootin for some food, and up from the ground would come a bubblin crude.

0 Comments:

Post a Comment

<< Home