A New Bullish Thesis

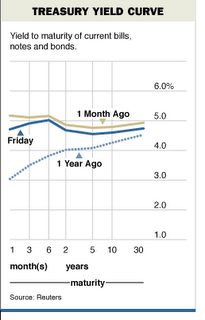

Lots and lots of chatter out there about the inverted yield curve (you can do a google search and find more than you can ever read, and/or you can check out this very good interactive chart for a quick refresher).

Conventional wisdom tells us the structure of our current yield curve- in addition to a number of other variables- puts a material probability on a recession.

Meanwhile, there's a considerable number of economists and strategists that say just the opposite.

RealMoney contributor and ING Guru Jim Griffin is one of them.

Mr. Griffin has written an excellent "executive summary" of a more comprehensive piece in The Economist. Frankly, I'm surprised this hasn't received more attention this week.

Bulls, Bears, and fence-sitters alike, will find both worthwhile reading.

Synopsis:

The Developing World Reaches Maturity

by Jim Griffin, Economic Advisor

If you would like a concise but comprehensive big picture of the economic backdrop for many of the concerns that get priced on a daily basis in financial markets, the current edition of The Economist includes a survey of the world economy that provides just such a synthesis. If you tend to get buried in the details of your daily grind, I recommend it to you.

If you would like a concise but comprehensive big picture of the economic backdrop for many of the concerns that get priced on a daily basis in financial markets, the current edition of The Economist includes a survey of the world economy that provides just such a synthesis. If you tend to get buried in the details of your daily grind, I recommend it to you.Its primary point is that while the developed and emerging parts of the global economy are now in rough balance in terms of contribution to total global output, they are at a tipping point in terms of their relative importance going forward. If, like me, you have tended to think of the developed world as the global engine and the emerging markets as the caboose, a not unreasonable orientation given 19th and 20th century history, it is now time to consider swapping ends on that arrangement.

Much of what is written in this survey will not be new to you. What is different, intriguingly so, is the conclusion drawn: that the emerging world may be nearly ready to fly on its own. It may soon be ready to drive its own growth and development, with less dependence on rich world assistance in the forms of capital and technology transfer or demand propulsion. It may also, before too long, reverse the polarity of cause and effect in global economics: That old image of the United States sneezing and the rest of the world catching cold may once have been appropriate but in the years ahead the causation may run the other way between the developed and developing parts of

the world.

Unlike the parade of 30-second sound bites we're used to, this bullish thesis deserves thoughtful consideration. However, I should point out it is also possible the US could have a recession while the rest of the world plods along without us (think: Japan in the 1990's).

0 Comments:

Post a Comment

<< Home