A Sample of What I'm Watching

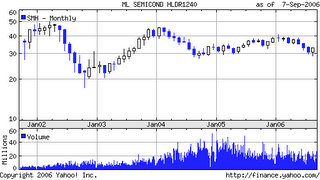

The market is a little wobbly lately, after a classic summer rally. A lot of smart folks don't trust that low volume bounce off the June lows. Makes sense. But I think it helps to "zoom out" sometimes and look at a long term chart. This is especially true of the Semi ETF (symbol SMH). The 5 year chart shows we are simply near the bottom of a range, and reminds me how many times we've heard tech is poised to re-establish its leadership position. On the other hand, if this bounce fails and we break below, say, 30, I think the rest is obvious. Whether you're Bull or Bear this could be a very important tell.

James "RevShark" DePorre, who blogs on the premium RealMoney site has a piece available for free on TheStreet.com. He has always amazed me with his sixth sense for the market. I also like the way he blends technical analysis with common sense.

The recent low-volume rally created what is known as a "bearish wedge" pattern in the major indices. This is simply an uptrend on light volume with no consolidation along the way. It is vulnerable to sharp selloffs because the market players who are accumulating gains along the way are likely to sell quickly and aggressively to lock in profits once things start to slip. This selling has a tendency to gain momentum and feed on itself because no one wants to see their recent gains suddenly turn into losses.

Most polls agree the Republicans are struggling right now. This is a good article among a few hundred on the subject I found with a simple search. But I don't need the media to tell me the GOP is in trouble. Frankly, I have been shocked by the number of friends- some of whom are lifelong Republicans- that have told me they will flat out "protest vote" for Democrats across the board in November. At first I took it as an idle threat. Now that I've heard the same intense frustration a dozen times it makes me wonder if voters are going to get out the broom.

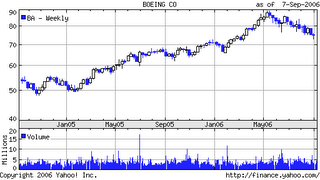

The investing part of this issue is important too. During the time my party has been spending like a bunch of drunken sailors, which has included a massive increase in defense spending, the defense contractors have had a huge run. No surprise there. But I noticed a few months ago, Boeing, for example, stopped going up, despite what has been continuously good news flow (note Boeing's weakness continued during the recent rally). It's possible this is an example of the market looking over the horizon, because it's pretty clear the enormous rate of change in defense spending after 911 has hit a plateau. In addition, if the economy is indeed slowing, cyclical stocks will certainly struggle. [Note: I'm NOT making a political statement here. Any observer of history will remember these war time surges in spending have normally been followed by 1) inflation, and 2) a public backlash that leads to cuts in defense. This is a brief glimpse of my post-war/post-Bush thesis that I need to address more fully. The key point here concerns a potential sea change in the public's mood toward the deficit stimulus that has no doubt been a contributor to the overall liquidity sloshing around in the system.]

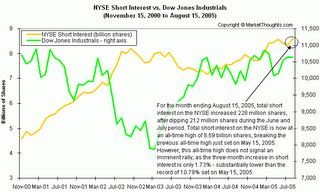

Short interest continues to set new records. Explains some of the distrust of the recent rally, since short covering tends to be artificial. See MarketThoughts for an interesting summary of recent market stats such as these. Also makes me wonder how far and fast we can go down when there are that many hedge funds crowded over on one side of the boat.

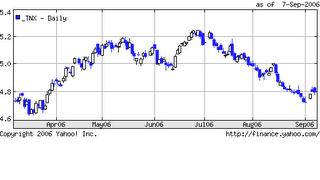

Ten year yield (and inverted yield curve). As I said in a previous post: market going up, bond yields down a lot... someone is very wrong here. Or if we paraphrase one of my all time favorite Greenspan quotes: "Rising [risks] have been advertised for so long, and in so many places, that anyone who has not appropriately hedged his position by now, obviously, is desirous of losing money." Or maybe that explains the record short interest?

Ten year yield (and inverted yield curve). As I said in a previous post: market going up, bond yields down a lot... someone is very wrong here. Or if we paraphrase one of my all time favorite Greenspan quotes: "Rising [risks] have been advertised for so long, and in so many places, that anyone who has not appropriately hedged his position by now, obviously, is desirous of losing money." Or maybe that explains the record short interest?

1 Comments:

my family almost always votes Republican and almost everyone will vote Democrat this time also ... I'm the lone standout and I'm having a difficult time making up my mind -- a first

Post a Comment

<< Home