John Mauldins Weekly e-Letters

John Mauldin does two weekly e-Letters: Thoughts from the Frontline, and Outside the Box. "Thoughts" are his own musings largely based on the avalanche of material he's been reading during the past week. "Outside the Box" (my fave) is a guest forum providing what is frequently a provacative viewpoint.

You can sign up to receive both for free by simply entering your email address and following the steps here. I have been receiving both for several years without additional spam or or any other hassle.

This week both are worthwhile reading.

In this week's Thoughts, he ponders the similarities between the current market and what we saw around Labor Day back in 2000.

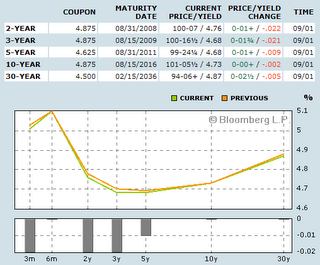

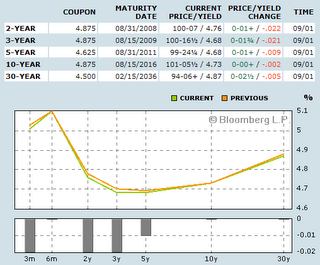

You'll also find a few interesting charts that, among other things, remind us we have a stubbornly inverted yield curve- and why that has proven significant in the past.

This weeks Outside the Box features the latest musings from Bill Gross, which I found to be an interesting long term view of our fiscal problems, from the unique vantage point of a Pre-Boomer (Gross was born before the baby boom kicked into high gear).

There are a lot of folks out there that immediately dismiss anything Bill Gross says because, as one commentator put it, he reminds them of the story of The Boy That Cried Wolf. No comfort there, when you consider the wolf eats the kid while his baby boomer mother ignores his pounding on the door (couldn't resist that one).

Inverted yield curves, housing problems, black fiscal holes in the universe obviously have nothing to do with what the market is going to do tomorrow (when we all return to the Church of What's Happening Now). But still, I do have to wonder what Senator Julio is thinking these days.

You can sign up to receive both for free by simply entering your email address and following the steps here. I have been receiving both for several years without additional spam or or any other hassle.

This week both are worthwhile reading.

In this week's Thoughts, he ponders the similarities between the current market and what we saw around Labor Day back in 2000.

In September of 2000, economists and bullish money managers were telling us that "This time it is different." They specifically pointed to the fact that the market was close to making new highs. We were heading for a soft landing. Not one of the Blue Chip economists at the time was predicting a recession. As an aside, we now know the economy was slowing dramatically and would be in recession by March of 2001, two quarters before the normal four quarters the Fed study suggested.

The Fed would be cutting rates less than five months later, but as we know, a recession came anyway. I distinctly remember Jim Cramer writing (pounding the table in his own unique style) that when the Fed started cutting in January you HAD to buy the market. He cited data that the market was up 12 months after the Fed started a rate-cutting cycle. He was a tad early about getting back into the market.

You'll also find a few interesting charts that, among other things, remind us we have a stubbornly inverted yield curve- and why that has proven significant in the past.

This weeks Outside the Box features the latest musings from Bill Gross, which I found to be an interesting long term view of our fiscal problems, from the unique vantage point of a Pre-Boomer (Gross was born before the baby boom kicked into high gear).

Too late to have babies, too politically sensitive to import more workers, too daft to recognize that the boomer winter is rapidly approaching and that our assets will not fund our liabilities. Too, too. Too, too. Too, too. What does a government do that is too absorbed in the moment and fails to alert its citizens to the perils ahead?... It devalues its currency, it reflates/inflates its economy, and because that doesn't create real wealth, it recites the mythology of a bygone era, of a "shining city on a hill," so that its citizens believe they've never had it so good. Well, as I acknowledged at the start of this Outlook, some of us never have had it so good, but the demographic season is changing and a rebalancing, more equitable distribution of our rather meager stockpile of nuts lies ahead. Corporate profits, nearing a record percentage of GDP will ultimately be taxed at higher levels in order to assuage a populist ballot-box revolt. And U.S. stocks, the present value of which represents the future value of private sector wealth creation, will stutter, perhaps stagger, as investors understand that much future wealth has been spoken for, if not already digested, by a boomer generation acting as consumers of first and last resort.

There are a lot of folks out there that immediately dismiss anything Bill Gross says because, as one commentator put it, he reminds them of the story of The Boy That Cried Wolf. No comfort there, when you consider the wolf eats the kid while his baby boomer mother ignores his pounding on the door (couldn't resist that one).

Inverted yield curves, housing problems, black fiscal holes in the universe obviously have nothing to do with what the market is going to do tomorrow (when we all return to the Church of What's Happening Now). But still, I do have to wonder what Senator Julio is thinking these days.

0 Comments:

Post a Comment

<< Home