Fork in the Road

Every once in a while we reach an economic point that gives me a profound sense of standing at the proverbial "fork in the road".

I remember talking to clients back in early 2003 of having that same feeling. According to the Fed, and a lot of other very smart folks, we were standing at the edge of a deflationary abyss (certainly not a good thing for stocks). Yet the market had taken off and put in a higher low, gold and other commodities (inflationary red flags) were moving up, and so on. Meanwhile, interest rates had plunged to 45 year lows.

As I summed it up at the time: SOMEBODY is very wrong here.

Turned out to be the Fed and all those smart bond traders: after about a 20 year bull market in bonds we reversed course and yields moved sharply higher; and after 50-80% declines in the stockmarket, between 2000 and the end of 2002, we enjoyed a ferocious rally.

As summer winds down I get a similar feeling.

On the one hand the Fed is telling us inflation won't be a problem- because the economy is slowing (certainly not a good thing for stocks). The bond market has bought into that line of thinking across the inverted yield curve.

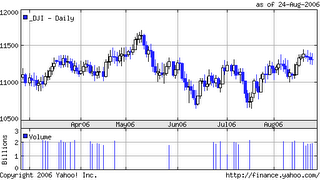

Yet the stockmarket has been hanging tough, climbing that wall of worry, and commodities are still very high- including oil, which has one eyeball on Iran and now the other on Tropical Storm Ernesto.

Not to mention all the handwringing over the housing market (and what impact that might have on the broader economy if we lose that leg of the stool).

Seems everyone has a full plate of scared, right?

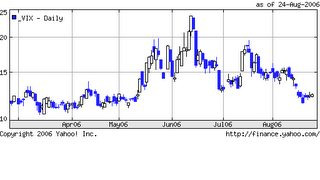

Not really. The volatility indexes hit the snooze button this summer and rolled back over. And to my surprise I've seen a half dozen charts that measure various forms of fear that look the same.

Not really. The volatility indexes hit the snooze button this summer and rolled back over. And to my surprise I've seen a half dozen charts that measure various forms of fear that look the same.Honestly, I think everyone, including the Fed, is idling at said fork wondering what to do next. We're watching for hints about 3rd quarter earnings, waiting for the next set of inflation numbers, talking to our friends and family about the housing market, and worrying about plenty. But nobody wants to go first.

But no matter your bias... SOMEBODY is very wrong.

Update (Aug 26): Bill Cara ponders the fork in the road, or as he calls them, "crosscurrents", in his detailed week in review. Interesting to consider the relationship between the stock and bond market over the past few months.

2 Comments:

The fork in the road has everything to do with our national expression of power eminating from a constant weakening of military and political influence in the world. For a glimpse of things to come, we need only to view the failed Presidency of Jimmy Carter in 76-80.President Bush has been pushed by appeasers and pacifists into a blind corner,where Islamo fascists and the real culprits - Russia and China, await.Charts are meaningless to a capitalist system if the guns and national will aren't there to protect and defend.

And things get worse in 2008.

The Book of Revelations wasn't quite what I had in mind.

For some reason I'm reminded of a line from Monty Python's, "The Meaning of Life", after the Angel of Death has just declared that everyone at the dinner table is DEAD.

The stereotypically chipper english host then does his best to put a happy face on the situation, announcing to his guests:

"Well! That throws a rather gloom over the evening doesn't it?!"

Post a Comment

<< Home