Junk Bond Bubble

There has been quite a bit of research and analysis done on what has been called "rolling asset bubbles" (search the phrase and you'll find more than you can read on the subject).

I'm intentionally avoiding the various debates about whether or not this or that asset class is technically sporting a bubble, because the point here is to offer a heads up about the next disaster in the wings.

Most agree the "Y2k bubble" got the ball rolling. As the air came out there was a lot of money that went looking for a home:

- Commodities

- Real Estate

- Emerging Markets

- High Yield (Junk Bonds)

Each asset class has its own peculiar characteristics, and each has a history of cycles-- some more severe than others.

The stock market bubble popped (ie, the Nasdaq declined 80%), the Fed threw real estate under the bus, certain emerging markets have been hammered this year... but what gives with the junk bond market?

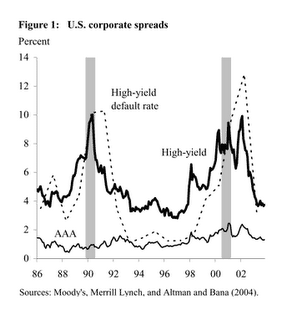

Credit spreads remain razor thin.

Frankly, there are a dozen great explanations out there as to why junk bond yields remain so close to risk free alternatives. But wading through all of that is a waste of time.

Using common sense will work just fine in this case. I'll illustrate what I mean using two examples:

The DooWop High Yield Fund (not going to use the real name of the fund here), with an average maturity of 10 years, currently yeilds 5.8%. Meanwhile, the ten year US Treasury yield is 4.82%. That means you're getting one lousy extra percent for a basket of high risk bonds issued by companies with low credit ratings.

Here's the problem: as recently as 4 years ago credit spreads traded 5-10% ABOVE treasuries (depends on which index you use). There have been extreme cases where those spreads spiked even higher. Thus, it is possible for junk bond prices to plunge even if the yield curve remained static.

This leads me to an anecdotal example. I have recently succeeded on a large account for an elderly couple well into their 80's. One of them has been in a nursing home for the past few years and unable to make even the most basic decisions for himself.

Long story, short: their financial advisor had loaded the boat on junk bonds.

Even if you were to explain all this to them they would not understand. Frankly, credit spreads, interest rate risk, and so forth, are just too complicated.

But that is only the most egregious example. I am not only seeing prospective clients with too much junk, but I know advisors that are still making a case for "overweighting" (using that term to be kind).

The reality is these folks are not leavening a portfolio due to an asset allocation model that argues for X% in a high yield basket. These are real world people simply reaching for yield aided by aggressive advisors selecting the funds from the best performing asset classes (using 1,3, and 5 year returns).

And you can take this entire discussion and apply it to preferreds (think about all the Ford preferreds floating around out there), REIT's, and any number of other creations that offer a higher yield through a basket of something that is much more complicated than nearly every retail client will honestly understand.

When the tide goes out again- which it certainly will- there will be an avalanche of supply coming from investors that had no clue about what they owned in the first place.

5 Comments:

Great post, I agree 100%.

I recently blogged about the evolution of the credit cycle, I think it is pretty clear that alot of investors are underpricing junk bond risk, and that risk has been papered over by strong economic conditions.

If that changes, it could get interesting.

. There has never been a Real Estate bubble. Doesn't mean it can't happen. But, what are the chances that if you bought a house for $500,000 today and the bubble "pops", that it's values goes down to $250,000 or even $150,000? And, can there be a financial bubble if it doesn't pop?

. The media has been doom and gloom about the real estate market and its pending bubble for years. They should be ignored. The realtor community continues to cheerlead for the housing market. They should also be ignored. The truth is, the market(s) move in cycles, of about 7 years, based on supply and demand. Keep in mind that just because one segment of the market, such as housing, reaches a peak doesn’t mean that other areas of real estate have peaked.

http://millionairenowbook.blogspot.com/2006/07/is-there-bubble-in-real-estate-bubble.html

Thanks, Larry.

No doubt the same sort of "rotation" we see among sectors in the stock market happens in real estate.

And like I said, not really interested in labeling this or that a bubble, per se...

... although there are folks in Anchorage/Dallas/Houston that would argue emphatically they saw a horrible bubble in R/E in the late 80's, where prices of SFH's dropped nearly 50% in certain neighborhoods along with declines of 50-70% in multi-family.

Note those specific markets experienced leverage on par with what we see across the country today.

jw

jw: Throw Southern California into the mix from 1991-1994. In each case, the local market got hit very hard because of industry unique to that location.

Even as we speak about the housing downturn (whatever that means), other sectors of real estate are thriving...especially in commercial.

What always happens at the end the housing cycle? Demand for rentals (especially apartments) goes way up. So do starter homes.

http://www.nytimes.com/2006/08/19/business/19rents.html?ex=1313640000&en=6ed20a76494f2d99&ei=5090&partner=rssuserland&emc=rss

Saltwater,

I'm not an expert on converts by any stretch. But back when I *thought* I was an expert, I found they acted like both a stock and a bond- giving me whiplash in the process.

Since I'm older and wiser now I stick with either common stock or bonds, depending on what's the best fit for the client.

That's not to say there aren't some very smart folks that have had good success with convertibles.

As for using a mutual fund (hiring said experts), I would just point out some of the largest convertible funds suffered 50% haircuts in the last bear market (despite the general claim that convertibles offer good upside and lower downside risk).

Regardless, if you or anybody reading this go that route, note there are open end and closed end funds specializing in the strategy... but be careful: some of those closed end funds are at steep premiums (to NAV).

Hope that helps.

Post a Comment

<< Home