The Stock Market is Going Up... uh, Right?

You should always try to find good bullish AND bearish analysis. You're better off giving weight to something rigorous, but it's also interesting to examine the process used to support the conclusion. In the grand scheme of things the former may be a mere data point; but the latter is important in order to develop critical thinking.

Then again, every once in a while you'll stumble upon an author's analysis that reaches a definite conclusion that... well, leaves you scratching your head.

RealMoney Contributor and ING Resident-Guru, Jim Griffin, in his weekly piece, is clearly bullish. But if you read his analysis with a little history in mind it makes you think he must have accidentally merged two different articles.

Mr. Griffin has unintentionally revealed some scary parallels to the markets of the late 60's and mid 80's.

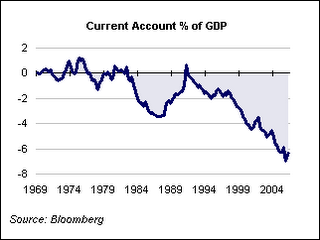

To be specific, he soothingly strolls through a few numbers and charts-- essentially saying, "Hey, the damage is already done!"-- but upon reflection he's picked two historical points (and a really ugly chart) that will make you spew your morning coffee.

As a reminder, investors piling in during the late 1960's didn't get their money back for 14 years; those investing at the bottom of that "mid-1980's" divot got beat up in the 1987 crash about the the time their trades settled.

By the way, let me say right here, right now: I LOVE Jim's stuff; he's always got that cool breeze view of the world that comes with a lot of experience during a lot of ups and downs. And it's not just a great writing style; he also has a gift for looking through a lot of market noise.

So not picking on Mr. Griffin. The main point is to illustrate the complexity involved in making long range forecasts using what may appear to be historical parallels. Put another way, a lot of smart folks could rewrite his essay using the same numbers and charts and offer a valid conclusion that is completely opposite.

Reference:

Encouraging Echoes of Cycles Past, by Jim Griffin

http://weekly.inginvestment.com/e_article000636127.cfm?x=b11,0,w

Then again, every once in a while you'll stumble upon an author's analysis that reaches a definite conclusion that... well, leaves you scratching your head.

Recession has once again taken a place in market chatter. The market’s mood, the slide into slump by the housing sector, the yield curve’s on-again, off-again flirtation with inversion, the Fed’s campaign (unpunctuated until last week) to reel in the monetary line it had previously played out – all make good talking points for the recession case. Nevertheless, I don’t find them convincing.

RealMoney Contributor and ING Resident-Guru, Jim Griffin, in his weekly piece, is clearly bullish. But if you read his analysis with a little history in mind it makes you think he must have accidentally merged two different articles.

Mr. Griffin has unintentionally revealed some scary parallels to the markets of the late 60's and mid 80's.

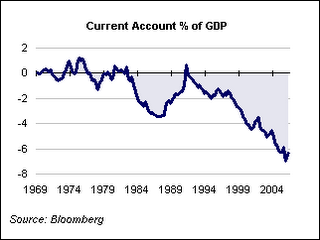

To be specific, he soothingly strolls through a few numbers and charts-- essentially saying, "Hey, the damage is already done!"-- but upon reflection he's picked two historical points (and a really ugly chart) that will make you spew your morning coffee.

As a reminder, investors piling in during the late 1960's didn't get their money back for 14 years; those investing at the bottom of that "mid-1980's" divot got beat up in the 1987 crash about the the time their trades settled.

By the way, let me say right here, right now: I LOVE Jim's stuff; he's always got that cool breeze view of the world that comes with a lot of experience during a lot of ups and downs. And it's not just a great writing style; he also has a gift for looking through a lot of market noise.

So not picking on Mr. Griffin. The main point is to illustrate the complexity involved in making long range forecasts using what may appear to be historical parallels. Put another way, a lot of smart folks could rewrite his essay using the same numbers and charts and offer a valid conclusion that is completely opposite.

Reference:

Encouraging Echoes of Cycles Past, by Jim Griffin

http://weekly.inginvestment.com/e_article000636127.cfm?x=b11,0,w

0 Comments:

Post a Comment

<< Home