Looking a Little Ragged

I've had a running commentary for a few weeks now about the market's persistent strength. During this recent leg of the rally we have seen selling pressure pre-market, and/or in the early going, overrun by strength all the way into the close. It's only one factor, and it is certainly simplistic, yet it is still an important gauge of the underlying bid.

In contrast, markets that are topping out will typically start with a gap higher and then fade through the rest of the session as the true believers continue to hope they've caught the bottom.

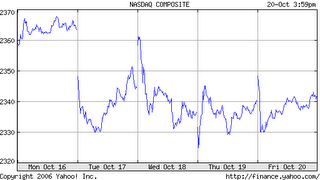

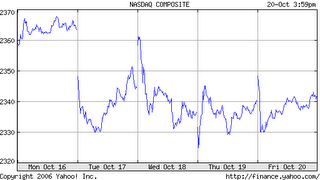

Last week (charts below) we still saw persistent buying in the Dow and S&P (think esp about Friday's rebound following the CAT imposion), but the Nazz definitely looked tired. And the closely watched Semi's threw up a caution flag.

It will be interesting to see the reaction to this week's news.

In contrast, markets that are topping out will typically start with a gap higher and then fade through the rest of the session as the true believers continue to hope they've caught the bottom.

Last week (charts below) we still saw persistent buying in the Dow and S&P (think esp about Friday's rebound following the CAT imposion), but the Nazz definitely looked tired. And the closely watched Semi's threw up a caution flag.

It will be interesting to see the reaction to this week's news.

0 Comments:

Post a Comment

<< Home